This is a free Disney SWOT analysis available for all students. You should use it only as a reference.

Company Details

| CEO: | Bob Chapek (Feb 25, 2020–) |

| Founded: | October 16, 1923, Los Angeles, California, United States |

| Headquarters: | Burbank, California, United States |

| Subsidiaries: | Walt Disney World® Resort, Hulu, Pixar, shopDisney,… |

| Founders: | Walt Disney, Roy O. Disney |

| Revenue: | 15.61B (Jan 2022) |

| Market Cap: | 220.48B |

Be it movies for adults or great cartoon content for kids, Walt Disney Company has always been at the fore of the market. Since its inception in 1923, the company has always enjoyed immense popularity and steady growth. Today, it is one of the most iconic brands in the world, not to mention one of the most lucrative ones.

Formerly Disney Brothers Cartoon Studio, now Disney, owes its success to producing exceptional content, marketing it to a vast potential audience, and acquiring competition to increase profits.

Still, with all the iconic brands and lucrative companies, Disney has to face a lot of internal and external factors.

In this article, we will go through each of the internal and external factors that the company is experiencing through the lens of a SWOT Analysis.

Do you need an excellent SWOT Analysis of Disney? We can help you with that! Our researchers can produce Disney’s SWOT Analysis with amazing accuracy and useful insights. Connect with us now!

Walt Disney SWOT Analysis

A SWOT Analysis is an investigative study to find and harness the forces that are acting upon a business. The research is conducted around four premises. Strengths, weaknesses, opportunities, and threats. The former two deals with the internal strategic factors of Walt Disney Studios while the rest of the two belong to the external ones.

To better understand the SWOT Table and its conclusive analysis, let’s go through the detailed study first.

Disney Internal Factors

Before we explore the external factors that are affecting or can affect the business model and operations of Disney, let’s dissect the internal factors, including its strengths and weaknesses.

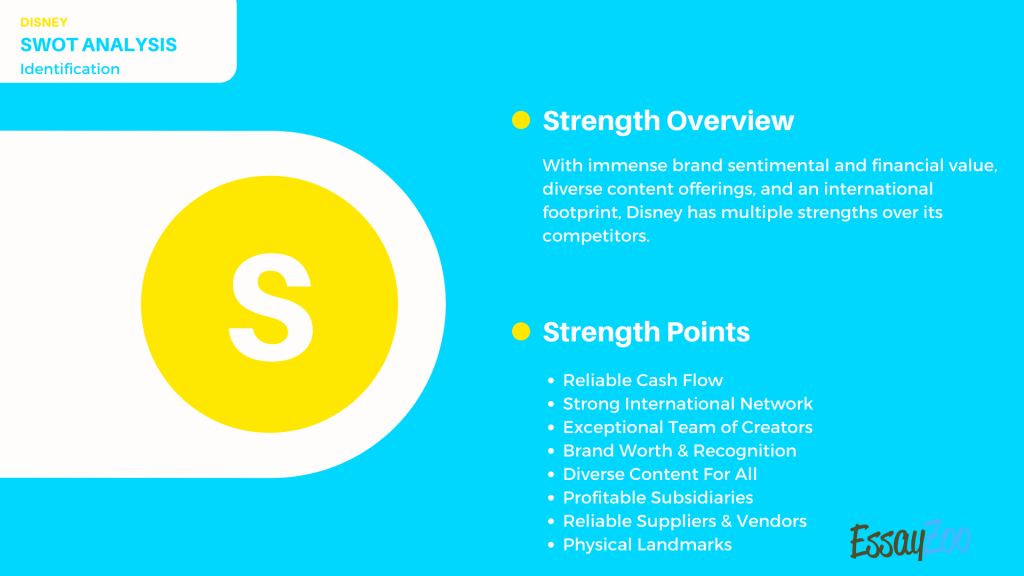

💪 Strengths

Being one of the most recognizable and beloved studio entertainment brands in the world, Disney enjoys a lot of comparative advantages over its competitors.

Extensive Cash Flow

Disney is one of the most influential entertainment businesses in the world. One of the things that had allowed the company to stay on top through competitive advantage is its reliable cash flow coming from different revenue streams. These include digital streaming, theme parks, cinema, etc.

Strong International Network

Disney has never been a regional brand. From day one, it has enjoyed immense popularity and growth at both home and abroad. The viewership of Disney belongs to the whole world, including regions like Asia, Africa, Europe, etc.

Exceptional Team of Creators

The company has always promised quality production and it has delivered that promise. All of that was possible because of employing highly skilled and adept creators. Disney boasts a large team of writers, animators, graphics designers, and so on in each of its media segments.

Brand Worth & Recognition

Being one of the most popular and recognizable brands in the world, Disney enjoys immense brand worth and recognition. The iconic “castle” at the beginning of a movie or the letter “D” in the corner of the screen is now iconic among movie watchers.

In terms of brand worth, Disney is among the top 8 most valuable brands in the world, according to Forbes, with an estimated value of over 52 billion.

Diverse Content For All

Even with the success of digital streaming platforms, many companies are struggling to either enter the segment or sustain their growth. Disney easily switched from conventional cable channels or cinema-based movie production to a diverse platform.

Now, an average person can enjoy Disney content at his home through Disney+ or go out with family and friends to watch movies by Disney, right at its theme park.

Profitable Subsidiaries

For a long time, Disney had to compete with other smaller companies. By successfully acquiring them, the company eliminated the competition while replenishing its portfolio.

Today, Disney’s daughter companies and subsidiaries include, Miramax, Infoseek, ESPN, 20th Century Studios, Searchlight Pictures, Pixar, Hulu, and many more.

Reliable Suppliers & Distributors

It has become a norm that Disney movies and content get the most exposure and reception. Part of the reason is its strong relations with suppliers and distributors.

Through them, it can market and showcase new iterations at a more advantaged position than its competitors.

Physical Landmarks

Disney is what visitors at the Disney theme parks want it to be. For many, it is a magical world filled with exciting characters from their favorite films and shows. This is a big point of strength for Disney because other competitors do not offer something tangible to their audiences.

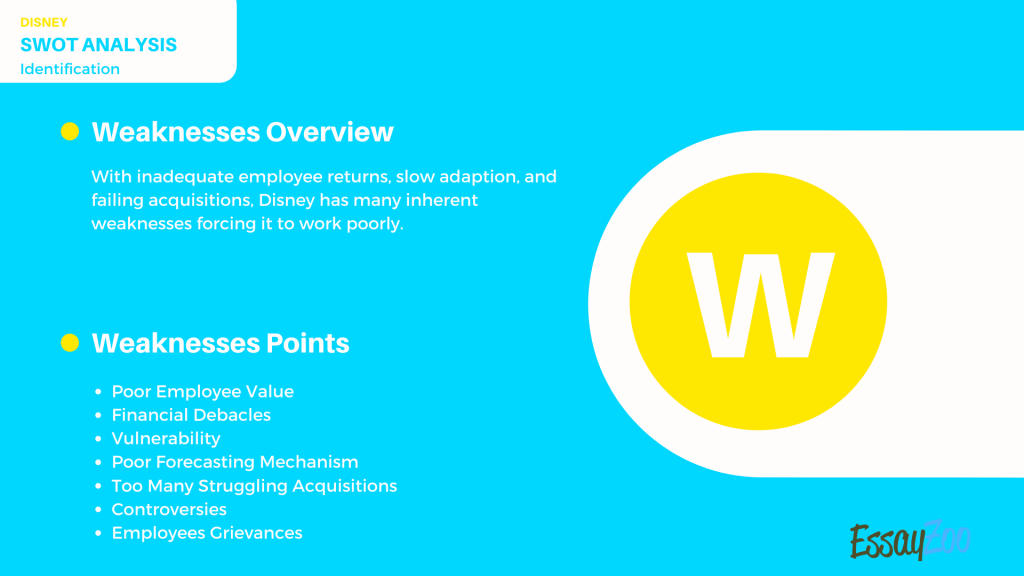

🤒 Weaknesses

Even though Disney is one of the giants in the current entertainment scenario, it is facing several internal challenges that are manifested in the form of weaknesses.

Poor Employee Value

Disney, as a company, believes in training and equipping its employees with the necessary tools and knowledge. The problem here is that the workforce is yet to materialize this setup by offering proportionate services to what they are offered.

Financial Debacles

From poor performances by Hulu and other streaming platforms to the acquisition of Fox at a higher price than the competition, Disney made some poor calls with poor financial planning that landed it in the proverbial pit. Even after acquiring Fox, Disney cannot make it compete in the market in its current form.

Vulnerability

Disney has always been shy of marketing and exposure of its name and products as a brand. Periodically, it gets out of the shadows during a movie release or the introduction of a new toy line. This has made it vulnerable to its competitor media networks that want to be ubiquitous.

Poor Forecasting Mechanism

Although Disney has embraced the online content streaming revolution, the company has yet to work proactively on that model. In many cases, Walt Disney fails to understand the gravity and didn’t grab on to a chance to redefine the brand or attract large swathes of audiences, in addition to poor financial planning.

Too Many Struggling Acquisitions

Big companies acquire other companies to eliminate the competition and let the company work for its benefit. In the form of Fox, the acquisition plan of Disney backfired. After acquiring the company for a hefty price tag, Disney has yet to carve out a sustainable plan to make it work.

Controversies

Disney’s executive was accused of making racist remarks. The issue became a full-on scandal when came to light. It affected the face of the company that was thought to be in line with social values.

Disney External Factors

Disney can avail many opportunities to expand and overcome its weaknesses. At the same time, the company is facing threats that can tip the scale against it.

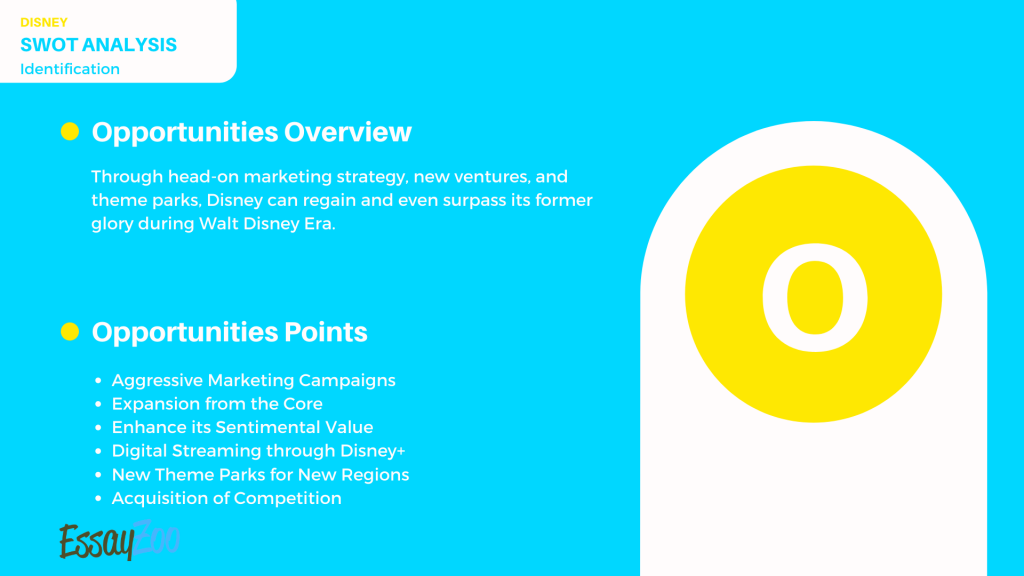

🤑 Opportunities

In terms of opportunities, Walt Disney Company has no shortage of these. Through these windows, it can ensure long-term sustainability and growth.

Aggressive Marketing Campaigns

Disney needs to shake things up in the marketing department to make its presence known again. Also, improving social media handles will be a big step in the right direction.

Expansion from the Core

Walt Disney Company can expand its portfolio from the core by innovating media-related platforms, products, and services which will help the company in widening its viewership band.

Enhance its Sentimental Value

Disney is much more about a production company for many, through its fantastic content. The company can leverage this by connecting more closely with its viewers.

Digital Streaming through Disney+

Disney+ is giving a hard time to its competitors through its exclusive, in-house content available at a much better price. Still, there is much room for content creation to enhance its portfolio.

New Theme Parks for New Markets

Currently, there is only a handful of Walt Disney Company theme parks across the globe. By making new theme parks for new markets, Disney can improve its relevance and popularity among the current and potential viewers.

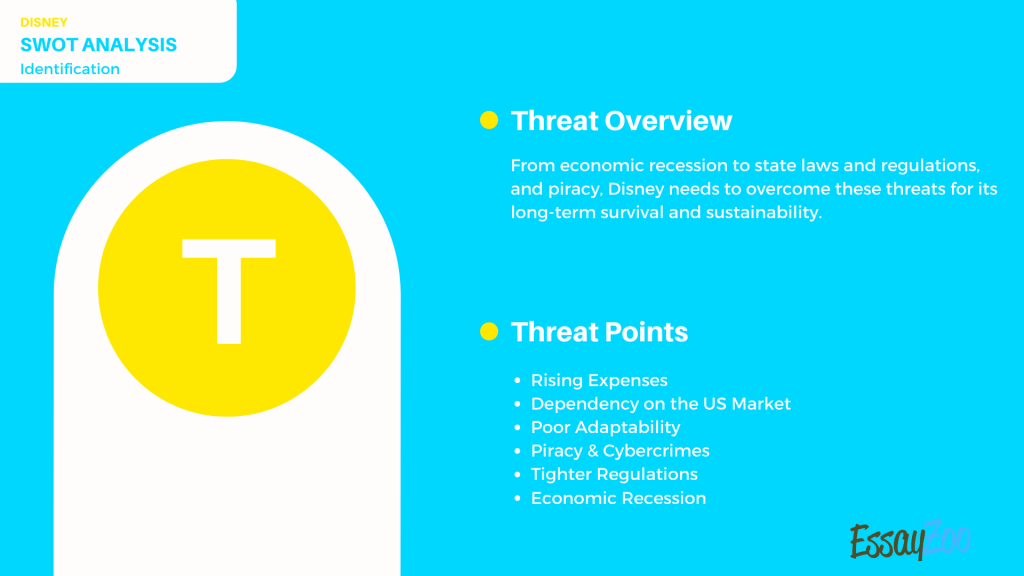

😨 Threats

Following are some of the external factors, including media networks, that are threatening Disney as they pose both short and long-term risks to its operations and business model.

Rising Expenses

Disney is facing financial threats in the form of rising operational expenses. With the thinning profit margins, the company is in a volatile condition which could deteriorate further.

Dependency on the US Market

Due to over-dependency on the US market as well as pulling out of international ventures and contracts, Disney is expecting a struggle to keep up with plummeting revenue.

Poor Adaptability

In some areas, the company has redefined itself by offering new lines of products and services. Still, it is struggling in making its mark when it comes to digital content streaming or adaptation of new models.

Piracy & Cybercrimes

Digital piracy and cyber theft are on the rise. Since all of the company’s interests are tied to the digital sphere, it will have a hard time making or sustaining profits in the both short run as well as long run.

Tighter Regulations

The US is planning to revise laws and regulations that govern relations between movie theaters and studios. For now, Disney is enjoying a privileged position but this cannot be said for sure in the future.

Economic Recession

Disney is not recession-proof because its products and services fall in the necessity category. With the uncertainty mounting during and after the pandemic, the company is facing a decline in its revenue as well as operating income.

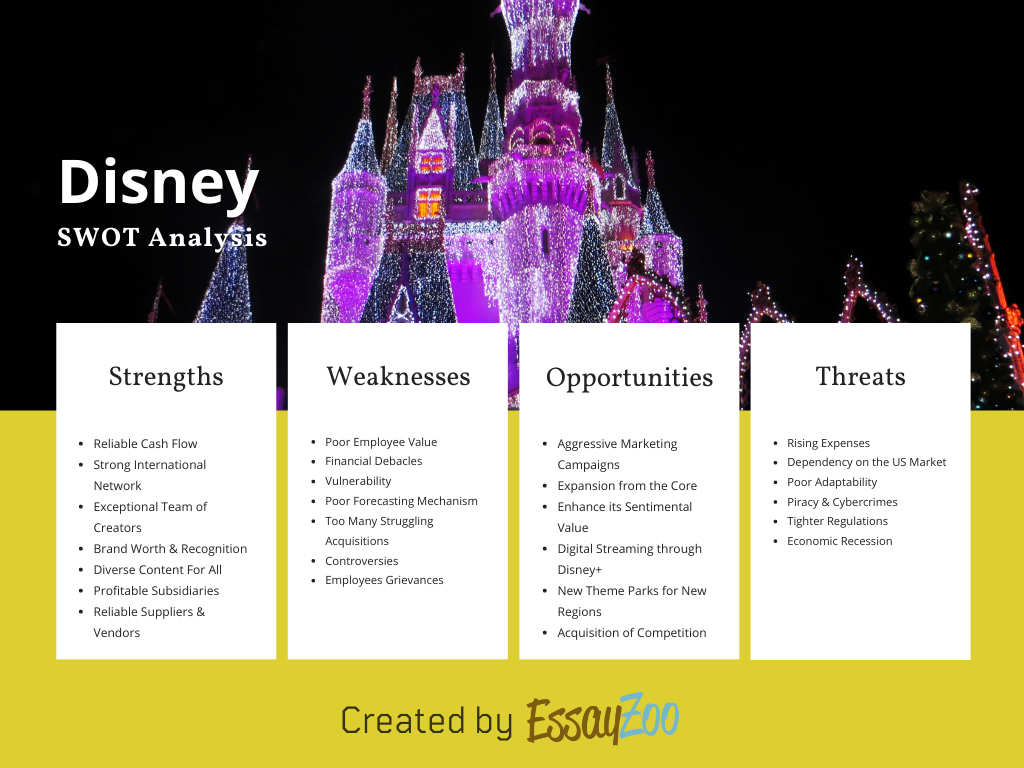

Disney SWOT Table

Strengths

- 💪 Reliable Cash Flow

- 💪 Strong International Network

- 💪 Exceptional Team of Creators

- 💪 Brand Worth & Recognition

- 💪 Diverse Content For All

- 💪 Profitable Subsidiaries

- 💪 Reliable Suppliers & Vendors

- 💪 Physical Landmarks

Weaknesses

- 🤒 Poor Employee Value

- 🤒 Financial Debacles

- 🤒 Vulnerability

- 🤒 Poor Forecasting Mechanism

- 🤒 Too Many Struggling Acquisitions

- 🤒 Controversies

- 🤒 Employees Grievances

Opportunities

- 🤑 Aggressive Marketing Campaigns

- 🤑 Expansion from the Core

- 🤑 Enhance its Sentimental Value

- 🤑 Digital Streaming through Disney+

- 🤑 New Theme Parks for New Regions

- 🤑 Acquisition of Competition

Threats

- 😨 Rising Expenses

- 😨 Dependency on the US Market

- 😨 Poor Adaptability

- 😨 Piracy & Cybercrimes

- 😨 Tighter Regulations

- 😨 Economic Recession

Read Also:

- Apple SWOT 2022

- A SWOT analysis for Nike’s company

- Dunkin Donuts SWOT Analysis 2022

- SWOT Analysis: Google

- SWOT Analysis of Starbucks

- Strategic SWOT Analysis of Facebook

- Informative SWOT Analysis of McDonalds

- Swot Analysis of Zara’s Current Situation

- In-Depth SWOT Analysis of Johnson & Johnson

- Airbnb SWOT Analysis 2022: A Detailed Report

- Burger King Company: SWOT Analysis

- Comprehensive SWOT Analysis of UPS

- Best SWOT Analysis of Chick-fil-A

- Walmart SWOT Analysis Essay

- Tesla SWOT Analysis

- Free Procter & Gamble SWOT Analysis

- SWOT Analysis for Amazon – Free Example

- Samsung SWOT Analysis In 2022

- Strengths, Weaknesses, Opportunities, and Threats of Netflix

- [2022] Toyota SWOT Analysis

- SWOT Analysis of Coca Cola Company